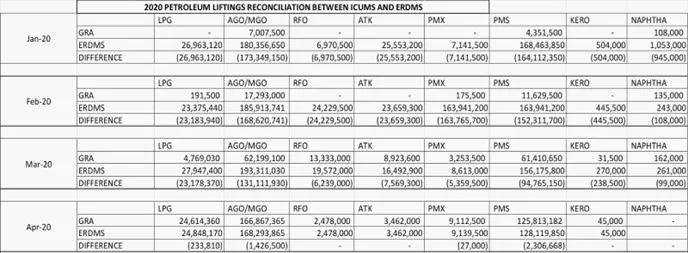

The Ghana Community Network Services Limited (GCNet), in partnership with the National Petroleum Authority (NPA) has successfully integrated the Ghana Customs Management System (GCMS) with the National Petroleum Authority (NPA), petroleum trading platform (ERDMS) to enhance tracking and collection of revenue in petroleum trading activities in the downstream sector.

With the seamless bridging of both the NPA ERDMS and Ghana Revenue Authority (GRA) GCMS platforms, players can have all transactions initiated on the ERDMS automatically validated in real-time on the GCMS before they progress through the stages.

By this, the GCMS, developed and deployed by GCNet for the Customs Division of the GRA will process petroleum orders and related payment requirements to ensure efficiency and transactional integrity.

A statement issued by GCNet in Accra yesterday said the principal goal of the integration was to ensure transaction integrity in the petroleum downstream trading activities with particular emphasis on maximising petroleum tax revenue collection.

"The move also ensures full automation of the processes of petroleum orders as the integration between NPA system and GCNet/GCMS is expected to facilitate efficient and effective collection of revenue accrued from petroleum orders by Oil Marketing Companies (OMCs) in their liftings," the statement.

The statement said effective July 1, 2018 all orders on the NPA system were transferred to GCMS where payment of duties will be calculated on the GCMS during declaration processing. GCMS will track the status of OMCs and update NPA on OMCs in good standing.

"This major milestone was necessitated by the need to address revenue gaps as a result of serious data integrity issues for industry players and government through the NPA petroleum trading platform (ERDMS), as well as ensure the integration between GRA-Customs and the NPA's platform," the statement.

The reverse is also true for OMCs and bulk distribution companies declaration transactions initiated on the GCMS which are validated with petroleum lifting order details transmitted to the GCMS from the ERDMS.

This makes it easy for the GRA-Customs to establish the tax status of OMCs without having to go through tedious transaction volume reconciliation sessions, reducing turnaround time and revenue losses to the state and OMCs.

The process flow is such that the OMCs place an order using the NPA system. The Bulk Distribution Company (BDCs) approves the order placed on the NPA system, which triggers checks by the depot manager for onward loading by the bulk road vehicle (BRV) all on the NPA system. A designated Customs official issues a release on the NPA system that allows all orders to be transferred to the GCNet /GCMS to be followed by the declaration of payment in the GCNet /GCMS.

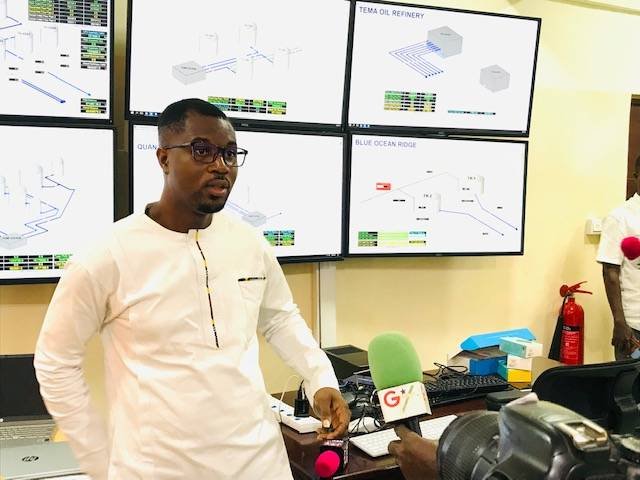

Explaining the successful integration of NPA system and GCNet / GCMS, a deputy manager at the Operations Department of GCNet, Mr. Anthony Nkansah recounted that the NPA-GCNet integration of systems completes the transaction processes between the two authorities which was commissioned in May 2018.

He enumerated some of the key indicators currently under monitoring to ensure seamless flow of the process and stressed that for each lift period, the GCNet / GCMS stores total volumes per product, to the extent that no OMC was allowed to place any further orders if payment is not effected for all quantities loaded earlier, within a given period, by payment due date.

On exemption for some loaded products, Mr. Nkansah indicated that when an order was placed for an exempted product, quantities will be reduced accordingly until all volumes are exhausted and cautioned that orders placed after end of exemption period is not allowed.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS