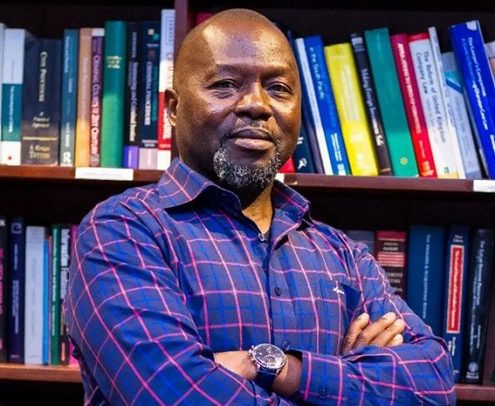

CEO-Margins ID Group, Moses K. Baiden, has revealed that by next year Ghana will launch a digital version of the universal national ID, the Ghana Card, to complement the physical one. According to him, just like the e-passport profile on the Ghana Card, the electronic ID profile is also already on the card and will be activated next year.

Moses Baiden said when the time comes, all information on the Ghana Card’s chip will be written on to the chip/SIM card in the owner’s mobile phone via an App, then a digital replica of the Ghana Card will be generated on the phone with a bar/QR code that can be read digitally for various purposes.

“Because the Ghana Card uses a chip and all your details can be written on it, they can also be written on the chip on your phone – so that where the physical Ghana Card is not available your phone chip can be used to verify your identity with a NFC (near field communication) device, also designed and developed by Margins.

“We will also have a digital ID Card which looks just like your original Ghana Card, with your picture, card number, date of birth and everything else – plus a bar/QR code that can be scanned from your phone screen for all purposes,” he stated.

Indeed, Kenya recently announced it is embarking on a project to provide citizens with digital ID cards but no physical ID cards. Moses Baiden however thinks that is not a good idea, particularly for a developing country where such a system does not cover all use cases and therefore limits its benefits to citizens.

He explained that that whereas the Ghana Card’s digital version is just like the actual Ghana Card and equally efficient, when a holder’s phone dies the digital version cannot be accessed for verifications.

Again, the physical card is necessary because not everyone has a phone, and the infrastructure to read the digital ID is not yet available everywhere. “Because mobile phone penetration is significant, the digital ID can be a good addition to the physical Ghana Card; but we are not yet at a stage where we can discard the physical card and go completely digital,” he said.

But he insisted that for convenience it is important to have both in case one forgets to pick his physical ID card or loses it, then the digital one can be used for all purposes.

Ghana Card for payments

Moses Baiden said in spite of the several sarcastic jokes that have been made about the Ghana Card being used for payments, there is actually a payment application on the Ghana Card that can be used for financial transactions when activated. He explained that there are 18 segments on the Ghana Card, including the debit application – saying that “all we need is the legislation and the funds to activate all of them so Ghanaians can see, experience and fully benefit from the power of the Ghana Card”.

According to him, activating all 18 segments is expensive and by law Margins is supposed to pre-finance everything and prove it works before they will be paid by government – so it will take time for all to be activated.

Pre-financing by Margins

Speaking of pre-financing, Moses Baiden said previously when the law made it the responsibility of a state institution to design and develop the national ID, it took hundreds of millions of dollars over a 12-year period to issue only 900,000 cards – which were not issued instantly and did not even have all the features of the current Ghana Card.

During that period, the ID system designer was even a French multinational with Margins only working as a sub-contractor providing and printing cards. That raised issues of sovereignty and national security as a foreign entity was in charge of the country’s ID system.

“So, Margins came up with the idea that if you claim you can design and deliver an effective national ID system and cards, why don’t you the contractor find your own money and do it so when it becomes successful you get paid. There was no point in paying contractors hundreds of millions of dollars to deliver an ID system that does not work,” he stated.

Margins, he said, has had the experience and infrastructure to design and develop reliable ID systems and infrastructure with international standards for years – the first of its kind in West Africa to be built and owned by Africans.

Instant cards

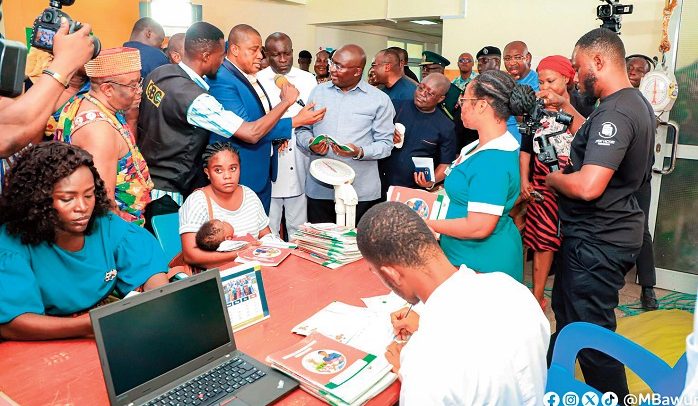

Once the green light was given, Margins started by piloting with foreigners’ ID cards, with a system designed to issue cards instantly at least 85 percent of the time; unlike the previous one, wherein applicants were issued with chits and were asked to come weeks later for their cards; many of which were not ever issued with the cards at all.

Over the past 15 years, Margins has been pre-financing everything regarding the Ghana Card and only gets paid after work is done; and the company has solved the country’s 50-year-old problem by providing a reliable universal national ID card that promises to revolutionalise national development, particularly in the area of social, political and financial inclusion.

Now, with the investment and ingenuity of Margins Group, a completely locally-owned company, the National Identification Authority (NIA) is able to issue Ghana Cards to applicants 15 years and above instantly and for free. This far, over 85% of Ghanaians have been issued with valid Ghana Cards.

US$1.5billion leakage eliminated

Moses Baiden said by developing the Ghana Card, Margins has saved the state over US$1.5billion, which was what over 20 state institutions spent collecting data from individuals who accessed services from them over the 15-year period without the Ghana Card.

“Now that the Ghana Card is here, state institutions do not have to use manual and expensive means of collecting individual data any longer – people can even go online and apply for services, authorise access to their details and the service will be delivered once the details are verified without the applicant having to physically visit the offices of that state institution,” he said. “SSNIT is doing it, NHIA is doing it, some banks are also doing it and several other institutions are doing it.”

He however noted that there are a few human behaviour hurdles to cross, since certain individuals and even some institutions still require a physical appearance before services are delivered – adding that it will take time, but soon all that will go away.

Online/offline card readers

Beyond developing the card, Margins has also developed NFC card-readers which enable the ID details to be verified for all use cases; even in situations where there is no Internet and/or electricity. The card-readers, which come in both table-top and handheld versions, can read all profiles on the Ghana Card – and can also do biometric checks, both online and offline. They have a unique National PKI in order to ID even terrorists and other antisocial characters.

Moses Baiden said policies and laws exist only to facilitate development for the people, but it takes a reliable ID system to know who the people are and what exactly their needs are – so that development planning will be more precise and effective. He said an efficient ID system is also critical to people knowing and accessing their rights and privileges, as well as fulfilling their duties and responsibilities to the state.

The Margins Group CEO believes the Ghana Card is the master key that provides the kind of precision needed in Ghana’s development to ensure no citizen or resident, whatever their status, is left behind.

The post Ghana Card to go digital next year appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS