…through improved reduction in widespread tax exemptions and concessions, robust administrative systems as well as diversifying its tax revenue streams under IMF ECF program.

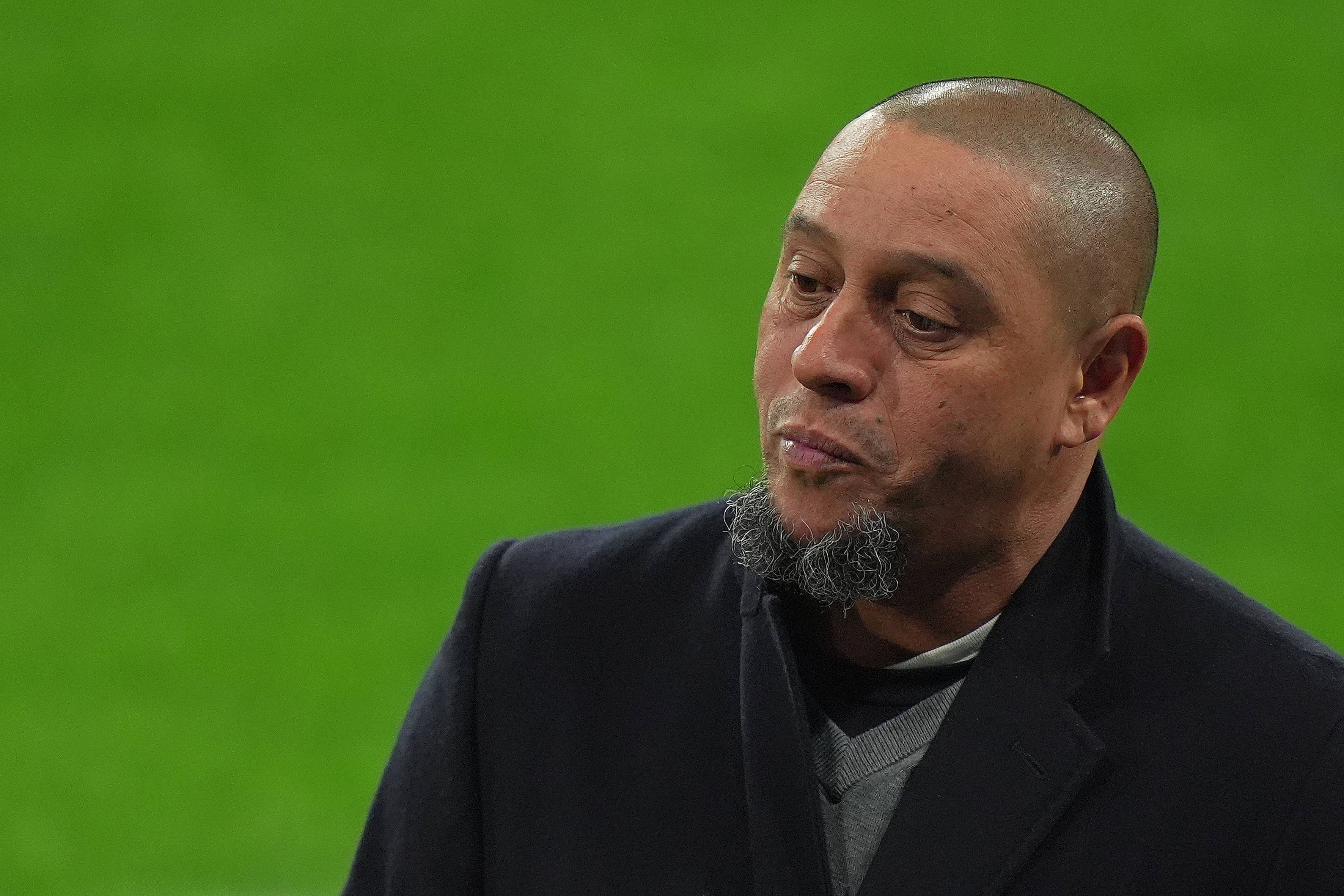

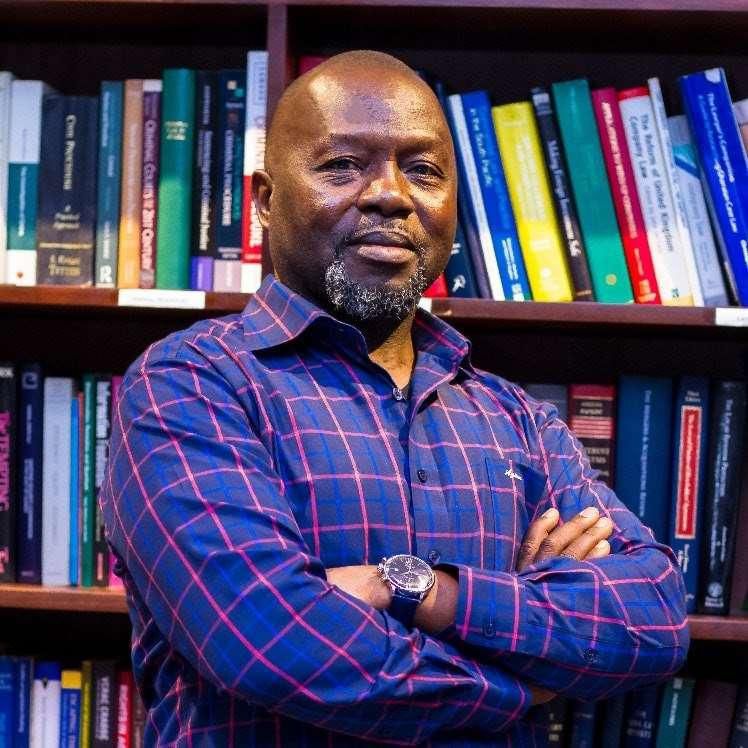

By Richmond Akwasi ATUAHENE (Dr)

Ghana has operated a property rate system which is administered by local authorities (MMDAs) without serious participation of central government and the related collections do not form part of central government revenues. Local authorities can assess taxes based on land value instead of property rate.

This would make the assessment faster and less cumbersome, and would discourage speculation. The property rate system should be jointly administered by central government and MMDAs. By implementing aggressive and equitable property taxes by the Government and MMDAs this will a long way to improve the Ghana’s tax to GDP ratio.

Diversifying revenue streams is critical for enhancing Ghana’s fiscal resilience and sustainability (World Bank, 2023). Ghana and MMDAs have all poorly performing property tax systems will need to identify and implement the appropriate set of policy and administration reforms to improve tax base coverage, property valuations, billing, collection, enforcement, and taxpayer services. Doing so can help the country realize potential property tax revenues in a more equitable and efficient manner.

Property-related taxes have a strong potential for revenue mobilization, especially in rapidly urbanizing areas. In fact, urbanization is a wealth-creating process, causing rising land values, which, if appropriately captured, can provide funding for much-needed for both state and urban infrastructure and services.

The property tax base is immobile, which minimizes economic efficiency implications and is considered the least distortive tax instrument followed by consumption taxes, personal income taxes and corporate income taxes, respectively (Johansson, Heady, Arnold, Brys and Vertia 2008).

Due to its immobility, the property tax base captures the value of location-specific capital investments and benefits from government programs and services not captured otherwise through various fees, user charges, and other taxes. This allows the property tax to operate as a form of “benefits tax,” allocating the tax burden across properties with differential benefits as reflected in differential property values.

The immovable property tax base also makes it relatively easier to identify and capture the tax base and allows the property itself to be natural collateral in case of tax nonpayment. The property tax base also tends to fall more on those with the “ability to pay,” as immovable property is often a primary repository of wealth.

Finally, as a highly visible and politically sensitive revenue instrument, the property tax base can encourage more responsive, efficient, and accountable local governance and public service delivery

Fifth, IMF (2017) observed that the failure on the part of Ghana Revenue Authority to adequately deal with high net wealth Individuals including politically expose persons (PEPs) in Ghana (HNWI) and PEPs are individuals who have accumulated net worth to the level that places them at the very top of the wealth scale in a country are not prepared to the relevant taxes accounted for low tax to GDP ratio (IMF, 2017).

Net worth or wealth is defined as the value of financial assets plus real assets (land and buildings), owned by individuals and their immediate families, less their debts.

The definition of wealth includes personal wealth and wealth held in trusts, and in legal entities effectively controlled by the individuals and their families. Every tax administration must therefore face the challenge of ensuring compliance by the wealthiest individuals and political expose persons (PEPs) so that the public can see that the administration is fair and even-handed, and that no individual, no matter how wealthy or well-connected, is above the law.

These categories of people in Ghana have not been paying the relevant taxes on their wealth as done in Uganda and Rwanda Mobilizing tax revenues from the HNWIs presents enormous challenges to tax administrations due to complexity of their financial affairs, possible political influence, and usage of aggressive tax planning to minimize effective tax rates for inability of government to introduce equitable property rates in Ghana.

However, neglecting this highly visible group of taxpayers not only affects the country by sizable reduction of tax revenue collections from them, but can also lead to the erosion of trust in the fairness of tax administration.

The perceived unfairness in the tax system could serve as a cancer for tax administration and worsen non-compliance in the wider taxpayer population. High and rising incomes inequality in Ghana particularly necessitate tax compliance from these wealthy individuals to finance government’s developmental projects, without overburdening the poor.

The high net wealth individuals (HNWI) and political elites are those individuals who have accumulated net worth to the level that places them at the very top of the wealth scale in a country (IMF, 2017).

Mobilizing tax revenues from the HNWIs and PEPs presents enormous challenges to tax administrations due to complexity of their financial affairs, possible political influence, and usage of aggressive tax planning to minimize effective tax rates. However, neglecting this highly visible group of taxpayers not only affects the country by sizable reduction of tax revenue collections from them but can also lead to the erosion of trust in the fairness of tax administration.

The perceived unfairness in the tax system could serve as a cancer for tax administration and worsen non-compliance in the wider taxpayer population. High and rising incomes inequality in Ghana particularly necessitate tax compliance from these wealthy individuals to finance government’s developmental projects, without overburdening the poor. This project should devoid of any political manipulations and machinations and this could go long way to improve the fiscal space.

Sixth, World Bank economic update (2024) observed that Ghana’s inefficient tax administration has been crucial for effective revenue collection, but Ghana still faces challenges such as suboptimal compliance, obsolete technological infrastructure, and a lack of robust taxpayer education and support mechanisms. The Ghana Revenue Authority (GRA) is encumbered by deficiencies in data management and audit proficiency, which are critical impediments to its tax collection efficacy.

The pervasive informal sector in Ghana’s economy exacerbates these administrative hurdles, as a considerable segment of economic transactions elude the formal taxation framework (IMF, 2023). In contrast, countries like Rwanda and Cote d’Ivoire have made advancements in modernizing their tax administration systems.

Rwanda has notably harnessed technology to bolster tax compliance through digital filing and payment systems, thereby curtailing evasion and enhancing compliance. Kenya, too, has strengthened its revenue authority with improved audit functions and taxpayer services, which have improved compliance and increased revenue streams (World Bank, 2023). It would help if the program envisaged a stable and credible tax regime that would be characterized by simplicity and clarity and would provide appropriate investment incentives.

Seventh, the World Bank )2024) economic update on the country observed that the complex personal income tax (PIT) with numerous exemptions, has negatively impacted revenue collection.

PIT accounts for approximately 15 percent of Ghana’s total tax revenues and only 2 percent of GDP, below the SSA averages of 18 percent of revenues and 3.5 percent of GDP. PIT revenue has failed to keep pace with GDP growth, largely due to over-reliance on payroll taxes, which make up more than 99 percent of total proceeds. In 2022, fewer than 25 percent of adult Ghanaians paid payroll taxes under the Pay-As-You-Earn (PAYE) scheme.

The PIT system, although progressive with a seven-band rate structure, is undermined by a range of exemptions that shrink the tax base, including the exemption of retirement funds. The complexity of the tax system and insufficient enforcement efforts further contribute to poor compliance

Eighth, IFS (2017) has observed that Ghana mining sector has not contributed adequately to tax to GDP ratio like Botswana: The mining sector in Ghana has a dominant potential to contribute to national resource mobilization.

However, the sector’s contribution to government revenue has not grown at the same pace as the overall GDP growth, and the overall impact of the sector to national development, despite the mineral commodity boom, is not very visible.

This is because the incentives accorded mining companies have greatly limited the share of government revenue from the sector and constrained the opportunities for government to mobilize adequate resources to fund social and development programs.

The framework of the current mining legislation in the country, which generally seeks to encourage foreign investment, is not necessarily compatible with the maximization of revenue and attainment of social and economic development. The mining fiscal regime defines an array of taxes, rent, fees and tax incentives to foreign investors in the mining sector.

The range of capital allowances, list of mining related equipment and items exempted from custom duties, the non-payment of capital gains taxes, value added taxes (VAT), dividend withholding taxes, corporate income taxes, the huge offshore sales revenue retentions and the payment of royalty at the lowest allowable rate constrains domestic revenue generation, resulting in less visible contribution of the sector to national economic development.

The Minerals and Mining Act, 2006, (Act 703) provides for fiscal stabilization, mining investment and development agreements. These agreements are supposed to be signed by mining companies with mining leases for specific mining prospects.

The Act provides for companies to negotiate stability agreements to ensure that mining operators, for a period not exceeding 15 years, are not affected by new legislative enactments and amendments that would adversely affect their operations. In addition, companies with investment portfolios exceeding US$500 million may negotiate development agreements with the government.

Such agreements enable the companies to negotiate specific rates and quotas for royalty payments, income taxes for their expatriate employees, etc. that tends to limit taxes and non-tax revenue paid by the companies.

To ensure that the country benefits from the mining sector, in terms of growing its tax base, the government has to undertake a complete review of the mining fiscal regime and its investment and stabilization agreements. This will require a re-examination of the Minerals and Mining Act, 2006 (Act 703) and a review of mining contracts and agreements (IFS, 2017)

Ninth, IFS (2017) observed that the Free Zones Tax Concessions had contributed to the low tax to GDP ratio. Tax exemptions and concessions granted to operators in the country’s free zones also work to undermine effective revenue mobilization. According to the Free Zone Act, 1995 (Act 504), a free zone enterprise shall have the right to produce any type of goods and services for export, except goods that are environmentally hazardous.

Free zone operators and enterprises granted licenses under the Act are exempted from the payment of income tax on profits for the first 10 years from the date of commencement of operation, and the income tax rate after 10 years shall not exceed a maximum of 8%, while companies operating outside the free zone pay between 25-30%. Also, free-trade zone shareholders are exempted from the payment of withholding taxes on dividends arising out of their investments.

The issue here is that while the outputs of the companies operating in the free zones form part of the country’s GDP, not much taxes are paid by them due to the displacement of the tax bases, seriously eroding the country’s tax/GDP ratio.

This calls for a major review of the concessions granted by the Free Zones Act to enable the operators in the zone contribute significantly to government revenue (IFS, 2017).

The post Enhancing revenue mobilisation (part 4) appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS