The regulator has come under intense criticisms following the shutdown of nearly 40 percent of the 141 companies with various licenses to operate the country’s capital market.

Some of the criticisms have come from customers of these affected who accuse the regulator of looking on while they were exploited and unable to access their locked up investment.

The regulator in a statement announcing the mass license revocation explained that its current investigations point to the lack of resources to pay claims as a result of imprudent use of clients’ funds to fund related parties and high-risk enterprises in ways that breach SEC’s regulations.

Nevertheless, SEC said should any evidence be provided on the culpability of any SEC employee, it will not hesitate to apply sanctions which may include termination of appointment and referral for criminal prosecution.

Cleaning up the financial sector mess

The Bank of Ghana’s banking sector reforms has led to the prosecution of some former directors and shareholders of Capital Bank.

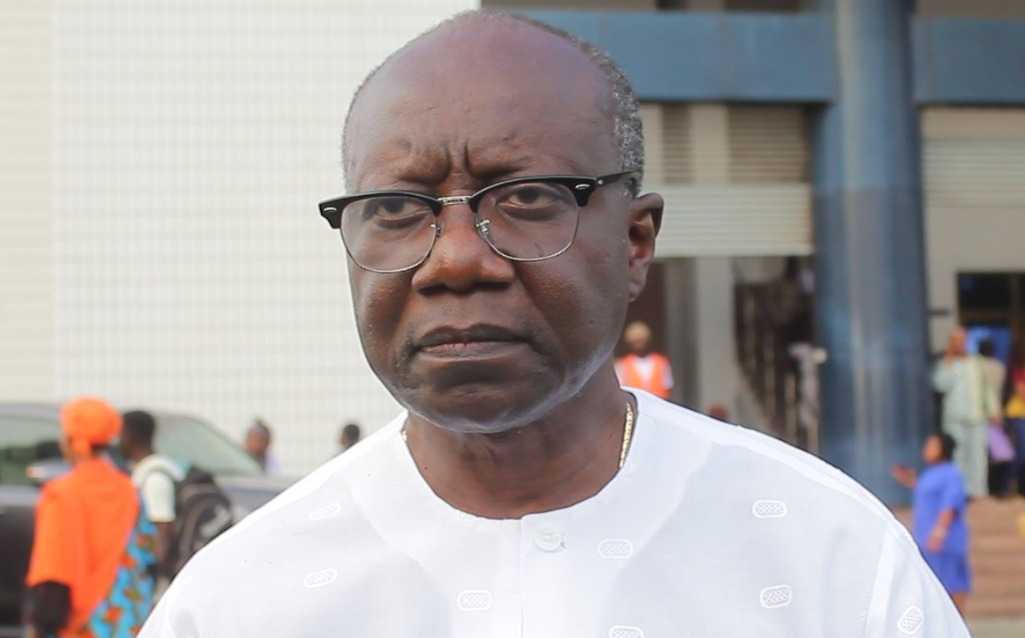

The state charged William Ato Essien, founder of defunct Capital Bank, together with three others with 26 offenses leading to the collapse of Capital Bank in 2017.

Also being prosecuted are three others: Rev. Fitzgerald Odonkor (former CEO of the Bank), Tetteh Nettey and Kate Quartey-Papafio (CEO, Reroy Cables) who played various roles at the Bank during its operational period.

The charges leveled against the four include multiple counts of conspiracy to steal, abetment of crime, stealing, and money laundering.

It is expected that at least about 50 more persons would be dragged to court by the state to answer for their various roles in the banking sector crisis which has so far caused the state about GH¢13 billion. Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS