… BoG’s next move as emergency phase fades

By Joshua Worlasi AMLANU

After two years of using gold as a stabilisation tool during Ghana’s economic adjustment, the Bank of Ghana is preparing to step back from direct gold trading and redesign the programme that helped rebuild reserves, calm the foreign-exchange market and restore confidence.

From January 2026 the central bank will exit small-scale gold trading under the Domestic Gold Purchase Programme (DGPP), handing operational control to the Ghana Gold Board. The shift is intended to strip fiscal risk from gold buying, respond to concerns raised by the International Monetary Fund and embed gold into Ghana’s reserves framework as a permanent policy tool rather than an emergency intervention.

The move comes as policymakers argue that the worst of the macroeconomic crisis has passed. Inflation slowed sharply in 2025 after aggressive tightening, while foreign-exchange reforms helped restore order to the cedi market. Gold buying, though costly, played a central role in that turnaround.

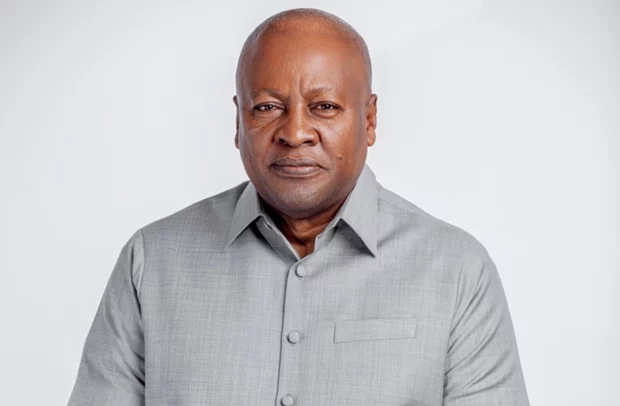

“Through the Domestic Gold Purchase Programme, external buffers were strengthened, FX pressures were moderated and confidence in Ghana’s external position improved,” Governor, Dr. Johnson Pandit Asiama said during the Bank’s New Year media engagement. “These programmes involved costs, but they delivered tangible stability benefits and should be understood as strategic interventions undertaken in support of macroeconomic and external resilience.”

From crisis tool to policy framework

At the height of Ghana’s balance-of-payments stress, the DGPP allowed the central bank to buy domestically produced gold and add it to reserves – reducing reliance on hard-currency borrowing. Gross international reserves climbed to more than US$13.8billion by the end of 2025 – equivalent to about 5.7 months of import cover, according to the Bank of Ghana.

However, mechanics of the programme exposed the central bank to trading losses. Between 2022 and 2024, cumulative losses from DGPP and the Gold-for-Reserves scheme exceeded GH¢7billion; with the largest hit in 2024 as the Bank absorbed discounts, fees and supply-chain costs on artisanal doré gold. IMF disclosures show additional losses of about US$214million, or roughly GH¢2.43billion, by third quarter-2025 on similar trades.

The contrast with GoldBod’s own financials has been stark. The Board reported revenue of about GH¢960million in 2025 against expenses of under GH¢120million, generating net income of roughly GH¢906million from the second and third quarters alone. Under the existing structure, the intermediary earned margins while the central bank bore market and operational risk.

This asymmetry has become harder to justify now that stability has largely returned. “With stability restored, 2026 is about consolidation and discipline,” Dr. Asiama said. “Programmes introduced during the period of adjustment – including those related to gold – will move toward more sustainable institutional and fiscal arrangements, ensuring shared responsibility and long-term viability.”

Operational exit, institutional handover

Under the new design, GoldBod will assume full responsibility for purchases, assays, exports, regulatory enforcement and anti-smuggling efforts, ending the transitional model under which the Bank of Ghana was directly involved in small-scale trading. The handover will be governed by the Ghana Gold Board Act, with the central bank stepping back to a reserve-management role.

The Bank notes that the exit is not a retreat from gold but a recalibration of how the metal is used. By removing itself from day-to-day trading, the Bank aims to eliminate quasi-fiscal exposure while retaining the macro benefits of reserve accumulation.

A joint policy workshop with GoldBod and the Ministry of Finance is planned for 2026 to refine the DGPP in line with international best practice. The discussions are expected to focus on clearer accounting, role separation and reporting standards, areas that featured prominently in IMF assessments of the programme.

“Beginning in 2026, the emphasis is quality over quantity – strong institutions, disciplined markets and policies that endure,” Dr. Asiama said, signalling that the central bank’s credibility gains would not be risked by ad-hoc interventions.

Cost controls and pricing reforms

Alongside the operational handover, DGPP is being retooled to address cost leakage. Intermediation fees, discounts and assay charges will be reduced to improve pricing efficiency and limit the fiscal burden. Payment-before-release rules will be enforced to minimise settlement risk, while structured gold-FX options and hedging instruments are expected to smooth foreign-exchange flows.

Officials familiar with these reforms say the objective is to ensure that gold purchases support reserves without creating hidden liabilities on the central bank’s balance sheet. External audits will validate GoldBod’s performance, while portfolio rebalancing will align gold holdings more closely with reserve-management objectives.

The changes come against a favourable global backdrop. Gold export earnings surged 71.4 percent to US$13.3billion in September 2025 from a year earlier, driven by higher volumes and prices. Global gold prices hit record highs above US$4,000 per ounce in October, supported by geopolitical tensions, expectations of lower interest rates in advanced economies and sustained central-bank demand.

Government’s 2026 budget projects prices to remain elevated, underpinning export receipts and strengthening the external position. That outlook reinforces the case for keeping gold within the reserve mix, even as operational risks are shifted away from the central bank.

GoldBod’s expanding mandate

For GoldBod, the handover could cement its role as the anchor of Ghana’s gold value chain. Since its establishment, the Board has implemented licencing reforms, introduced competitive pricing for miners and intensified efforts to curb smuggling – including through a dedicated task force and whistle-blower incentives.

The impact has been significant. Between January and October 2025, small-scale gold exports rose to a record 81.7 tonnes valued at about US$8.1billion, surpassing large-scale production in both volume and value for the first time. Removal of the 1.5 percent withholding tax on unprocessed small-scale gold also boosted formal exports.

GoldBod plans to roll out a comprehensive gold traceability system in 2026, ensuring that every gramme purchased can be traced to a licenced and environmentally compliant source. The Board has also been tasked with driving value addition, including partnerships with local refineries and plans for a “Gold Village” aimed at jewellery manufacturing and exports.

These ambitions underscore why policymakers want GoldBod, rather than the central bank, to manage the commercial and regulatory aspects of gold.

Macro implications

For the Bank of Ghana, the gold reset fits into a broader shift from crisis management to rule-based policy. In 2025, the Bank introduced a rules-based FX auction framework, tightened liquidity management and strengthened supervision across the banking system. The passage of amendments to the Bank of Ghana Act reinforced central-bank independence and safeguards against fiscal dominance.

In 2026, monetary policy is expected to remain measured and forward-looking, anchored on price stability and clear signalling. Inflation is projected as returning to the medium-term target band of 8±2 percent by year-end, while reserve money growth will be constrained by tighter liquidity management and stronger external inflows.

The external outlook is similarly supportive. Gross reserves are projected to cover at least three months of imports, with gold exports, remittances and foreign direct investment underpinning the balance of payments. A stable cedi and easing government financing needs are expected to support a gradual recovery in private-sector credit.

Against that backdrop, stripping fiscal risk from gold buying is as much about protecting recent gains as it is about policy design. The last three years’ experience has shown that gold can be a powerful stabilisation tool, but also that blurring the lines between central banking and commodity trading carries costs.

The Governor said the task now is to “embed the reforms of the past period into routine practice and ensure that stability translates into durable confidence”.

The post Stripping quasi-fiscal risk from gold reserve appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS