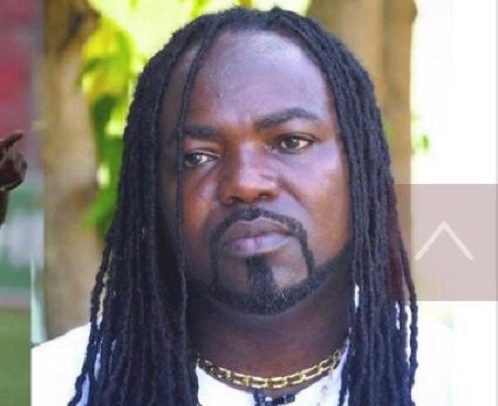

By Dickson Assan

Many employees in Ghana are surprised when they take a closer look at their payslips and notice that the PAYE tax deducted each month is sometimes higher than their pension contribution.

While the employee’s SSNIT deduction is limited to a mandatory 5.5% of basic salary, employee income tax in Ghana can rise to 25%, 30%, or even 35% for middle- and higher-income earners.

On paper, a gross salary may appear attractive. However, after PAYE and other statutory deductions are applied, the final take-home pay that reaches the employee’s bank account often feels far less encouraging.

What many employees do not realise, however, is that the Income Tax Act, 2015 (Act 896), as amended, provides several lawful reliefs and planning opportunities that can significantly reduce PAYE and ultimately increase net salary.

How PAYE is computed

To appreciate these opportunities, it is important to understand how PAYE is calculated. In simple terms, PAYE is based on an employee’s total employment income. This includes basic salary, taxable allowances, bonuses that exceed the allowable threshold, and non-cash benefits provided by the employer.

From this total, certain approved deductions are made, including SSNIT Tier 1 contributions, Tier 2 and Tier 3 pension contributions, and any personal tax reliefs the employee is entitled to claim. The balance that remains after these deductions is referred to as chargeable income, and it is this figure that the graduated PAYE tax rates are applied to.

Legal Ways Employees Can Reduce PAYE

One of the most straightforward legal ways to reduce PAYE is for employees to ensure they claim all available personal tax reliefs. A tax relief is simply an allowance granted to a resident individual to reduce taxable income and, by extension, the amount of tax payable. The law provides several such reliefs.

Marriage relief, for example, grants GHS 1,200 per year to a resident individual who supports a spouse or cares for at least two children, although only one spouse may claim this relief upon providing proof of marriage. Child education relief grants GHS 600 per child per year for up to three children attending recognised educational institutions in Ghana, provided evidence of fee sponsorship is available.

There is also an aged dependent relative relief of GHS 1,000 per year for up to two relatives aged 60 years and above, subject to proof of age and the rule that the same relative cannot be claimed by more than one taxpayer.

In addition, employees who undertake professional, technical, or vocational training to upgrade their skills may claim an educational relief of GHS 2,000 per year. Mortgage interest paid on a loan used to acquire or build a primary residence is also deductible from taxable income, thereby reducing PAYE while encouraging long-term asset ownership.

Persons certified as disabled by the Commissioner-General may further benefit from a disability relief equal to 25% of their income from employment or business. Unfortunately, a significant number of employees never apply for these reliefs through their Human Resource departments or directly with the Ghana Revenue Authority, which results in unnecessary overpayment of tax.

Another powerful but underutilised strategy for reducing PAYE is increased contribution to the Tier 3 pension scheme. Contributions to an approved Tier 3 provident fund or personal pension scheme are tax-deductible and may be made up to 16.5% of an employee’s basic salary.

Because these contributions are deducted before PAYE is calculated, they reduce chargeable income and therefore lower the total tax payable. For higher-income earners, this reduction may even shift part of their income into a lower tax bracket, producing additional tax savings while simultaneously strengthening retirement security.

Bonus structuring also plays a critical role in PAYE optimisation. Under Ghana’s tax rules, where the total annual bonus paid to an employee does not exceed 15% of the employee’s annual basic salary, the bonus is taxed at a final rate of only 5%. This represents a significantly more favourable treatment.

However, any portion of the bonus that exceeds the 15% threshold is added to the employee’s regular employment income and taxed at the normal graduated PAYE rates. This explains why some employees receive seemingly large bonuses but experience substantial tax deductions that reduce the final amount received.

Equally important is the way salaries and allowances are structured within compensation packages. In some cases, employers deliberately maintain a relatively low basic salary while allocating a larger portion of remuneration to cash allowances. Although this arrangement may appear beneficial at first glance, most cash allowances are fully taxable under Ghanaian tax law.

The result is a higher total taxable income, increased PAYE deductions, reduced pension contributions, and weaker long-term financial security. Salary structure, therefore, is not merely about the total earnings figure but about how compensation is arranged within the framework of the law.

Conclusion

Ultimately, PAYE is unavoidable, but overpaying PAYE is not. Employees who actively claim eligible tax reliefs, contribute strategically to Tier 3 pensions, understand the tax treatment of bonuses, and pay attention to salary structuring can lawfully reduce their PAYE burden and improve their net salary without breaching any tax regulation.

For this reason, Human Resource professionals, finance teams, and employees themselves must collaborate to design compensation systems that are compliant, tax-efficient, retirement-focused, and financially sustainable.

Dickson Assan is a Chartered Accountant, business and career coach. He works closely with SMEs on strategy, accounting, and tax planning.

Phone: 233 242 771 314 | Email: [email protected]

The post PAYE optimisation strategies: Legal ways to reduce PAYE and increase net salary appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS