By Prof. Samuel Lartey

Nations do not fail for lack of ideas. They fail when execution falters, reforms are abandoned midway, and discipline weakens under pressure. Ghana’s current economic recovery and reset agenda places the country at a defining moment where perseverance and discipline are no longer abstract virtues but economic necessities.

As inflation, debt restructuring, fiscal consolidation, and structural reforms converge, the decisive factor will be whether Ghana, as a state, its institutions, its businesses, and its citizens, can sustain the effort long enough to convert reform into lasting prosperity.

History shows that economic turnarounds are rarely achieved through dramatic announcements alone. They are secured through consistency, institutional discipline and the resolve to complete what has already been started.

Ghana’s recovery path illustrates this clearly. The country endured a severe macroeconomic shock between 2022 and 2023, marked by high inflation, currency depreciation and debt distress. The response has been painful but purposeful. The outcome will depend on perseverance.

Ghana’s economic recovery will be defined not by how boldly reforms are announced but by how consistently they are completed, making discipline to finish what we start the missing advantage that can turn sacrifice into stability, reform into results and recovery into lasting national progress.

Ghana’s Economic Reset in Context

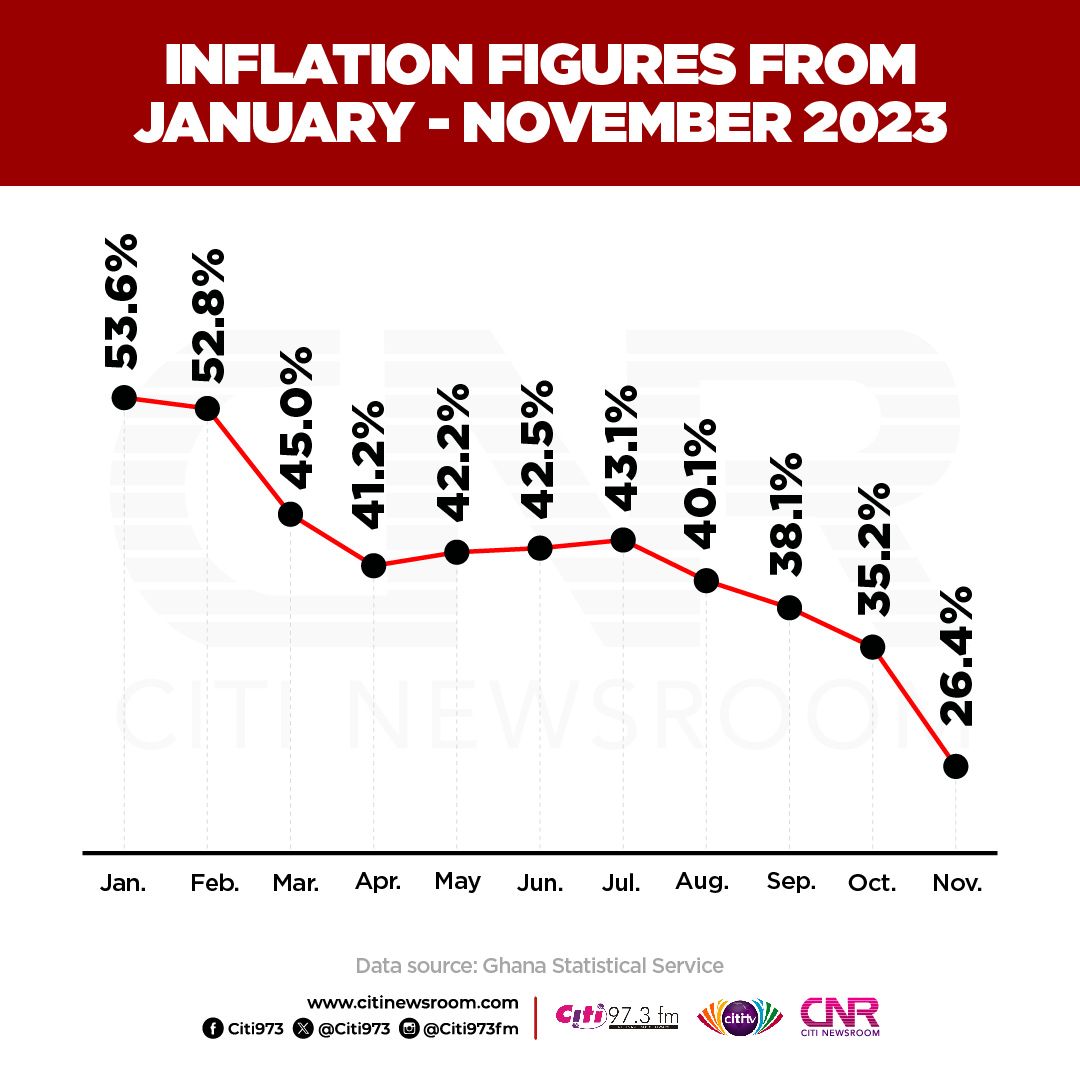

Ghana entered the current decade facing its most severe economic stress in over a generation. Inflation peaked at over 54 percent in December 2022. Public debt exceeded 88 percent of GDP. Interest payments consumed more than half of domestic revenue. Investor confidence weakened, and access to international capital markets closed.

In 2023 and 2024, the country embarked on a coordinated reset anchored in fiscal discipline, debt restructuring, monetary tightening, and structural reforms under an IMF-supported programme approved in May 2023. The reset was not designed for quick political wins but for long-term stability. Perseverance became unavoidable.

The lesson for Ghana is simple. Halting reform halfway would lock in the pain without delivering the gains.

Discipline and Perseverance in Public Sector Leadership

Fiscal consolidation is one of the hardest reforms for any government to sustain. It demands restraint under social and political pressure. Ghana’s medium-term fiscal framework commits to expenditure control, revenue mobilisation and a return to primary surpluses.

According to the Ministry of Finance, Ghana moved from a primary deficit of over 4 percent of GDP in 2021 to a targeted primary surplus by 2024. This improvement did not come from a single policy but from sustained discipline across tax administration, expenditure rationalisation and debt service restructuring.

The financial impact is significant. Every one percentage point reduction in the fiscal deficit saves the country billions of Ghana cedis in borrowing costs over the medium term and reduces inflationary pressure.

Institutional Perseverance and Reform Fatigue

Public sector reforms often fail not because they are poorly designed but because institutions lose momentum. Payroll audits, public financial management reforms, and state-owned enterprise restructuring require sustained consistency. Ghana’s past experience shows that abandoned reforms cost more than completed ones.

For example, incomplete SOE reforms between 2017 and 2020 resulted in energy sector shortfalls exceeding 2 percent of GDP annually. Sustained reform could have substantially reduced these losses.

SME Survival and the Cost of Quitting Early

Small and medium-sized enterprises account for approximately 70 per cent of employment in Ghana and contribute over 50 per cent of GDP. Yet data from the Ghana Statistical Service and the World Bank Enterprise Surveys consistently show that a significant proportion of SMEs do not survive beyond five years.

The core reason is rarely a lack of opportunity. It is weak capital discipline, inconsistent strategy and premature abandonment when conditions tighten.

Table 1: Business Perseverance and Economic Outcomes in Ghana

| Indicator | Evidence from Ghana | Economic Implication |

| SME contribution to employment | Approximately 70 percent of total employment | SME survival directly affects household income stability |

| SME failure rate within five years | Estimated 60 percent | High capital destruction and job losses |

| Cost of business closure per SME | Average loss of GH¢150,000 to GH¢300,000 | Reduced reinvestment and weakened credit culture |

| Firms that survive economic downturns | Outperform peers by up to 30 percent post recovery | Perseverance creates long term competitive advantage |

| Access to credit for disciplined firms | Lower interest rates and better terms | Financial discipline reduces systemic risk |

Sources: Ghana Statistical Service, World Bank Enterprise Surveys, Bank of Ghana Financial Stability Reports

Perseverance in business is not emotional optimism. It is a disciplined adaptation. Firms that restructure operations, manage cash prudently and invest in skills during downturns emerge stronger when conditions improve.

Entrepreneurs and Innovation: Finishing the Process

Ghana’s startup ecosystem has grown rapidly in fintech, agribusiness and digital services. However, venture data shows that many startups fail not at the idea stage but during scaling due to weak governance, poor financial controls and loss of strategic focus.

Global entrepreneurship research shows that founders who persist through the first two major business cycles significantly increase their probability of long-term success. Discipline in governance, compliance and customer focus separates sustainable enterprises from short-lived ventures.

Personal Discipline as Economic Resilience

Economic recovery is not driven solely by institutions. Individuals play a decisive role. Financial discipline at the household level improves national savings rates. Skill acquisition improves labour productivity. Perseverance in education and training increases lifetime earnings.

According to World Bank data, each additional year of education increases individual earnings by an average of 9 per cent in Sub-Saharan Africa. Abandoning education or skills training prematurely has a measurable lifetime cost.

Similarly, households that maintain savings habits during economic downturns recover faster and rely less on high-cost borrowing.

Discipline as the Bridge Between Reform and Results

Across government, business and society, the same pattern holds. Starting reform is politically attractive. Finishing reform is economically transformative.

Countries that exited IMF programmes successfully did so not by abandoning reforms early but by institutionalising discipline. Ghana’s own experience between 2001 and 2006 demonstrated this when sustained macroeconomic discipline led to debt relief, renewed growth and expanded fiscal space.

Conclusion

Ghana’s reset agenda is not a sprint. It is a test of national endurance. Perseverance and discipline to finish what we start are now the country’s most valuable economic assets.

For the government, this means sustaining fiscal and institutional reforms even when the immediate pain is visible, and the gains are gradual. For businesses and entrepreneurs, it means resisting short-term retreat and instead adapting with discipline. For individuals, it means committing to skills, savings and productivity even when conditions are tight.

Economic recovery is not guaranteed by good intentions. It is secured by those who remain consistent when momentum slows. If Ghana completes the reforms it has begun, the reward will not only be macroeconomic stability but also long-term prosperity, credibility, and resilience.

The post Discipline to finish what we start: The missing advantage in economic recovery appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS