By Kizito CUDJOE

Government’s plan to build a 1,200-megawatt (MW) state-owned thermal power plant has drawn cautious approval from independent power producers, even as energy policy think-tanks warn that long-standing structural and climate risks could undermine the project’s viability if left unaddressed.

Announced by the Finance Minister in the 2026 Budget Statement and Economic Policy, the project is intended to absorb an additional 150 million standard cubic feet of gas per day expected from the Offshore Cape Three Points (OCTP) and Jubilee partners, alongside supply from the second train of the Gas Processing Plant (GPP 2).

Government argues that the facility will strengthen energy security, stabilise power supply and reduce reliance on costly liquid fuels.

“This plant will support the provision of reliable and affordable power and secure Ghana’s energy future,” the Finance Minister said.

While the proposal has been welcomed in principle by industry players, the Africa Centre for Energy Policy (ACEP) cautioned that the success of a new state-owned plant will depend less on its technical merits than on whether the country’s power sector reforms can resolve deep-rooted financial and liquidity constraints.

ACEP noted that, on paper, the initiative appears to be a strategic effort to leverage domestic gas, cut exposure to expensive liquid fuels and restore state influence in electricity generation. It added that state ownership of power plants is not new, pointing out that Volta River Authority (VRA) already operates about ten plants with a combined installed capacity of 2,547MW.

However, the think-tank stressed that the critical issue is not the state’s technical capacity to run power plants, but whether prevailing sector conditions allow such assets to operate sustainably.

In its budget analysis, ACEP argued that VRA’s operations have, for years, been weakened by chronic payment delays and liquidity shortfalls across the energy value chain. As a result, maintenance cycles have suffered, debt levels have risen and operational efficiency has declined.

“Even with introducing the Cash Waterfall Mechanism (CWM) – which was designed to streamline payments – the system prioritises standing payments to independent power producers, leaving state-owned generators exposed to revenue shortfalls,” ACEP said.

The policy group acknowledged that government has initiated corrective measures, including renegotiating some power purchase agreements (PPAs) and plans to introduce private sector participation in electricity distribution.

It however warned that until these reforms fully take effect, a new state-owned power plant could face the same cash flow pressures which have constrained VRA for more than a decade – undermining its competitiveness and financial sustainability.

From the industry’s perspective, Independent Power Producers, Ghana (IPP-G) said the project could strengthen system stability if implemented on schedule; particularly because gas earmarked for the plant is incremental rather than diverted from existing facilities.

According to IPP-G, dedicating the additional 150 million standard cubic feet of gas per day to new generation capacity reduces risk of fuel displacement across the current thermal fleet.

“At an average delivered gas price of between US$6 and US$7.5 per MMBtu, this volume represents an annual fuel input value of roughly US$330million to US$410million,” said Chief Executive Officer (CEO) of IPP-G, Elikplim Kwabla Apetorgbor.

“Because this gas is incremental it avoids fuel rationing, which in the past has forced a switch to liquid fuels costing between US$18 and US$25 per MMBtu.”

He estimated that reliance on liquid fuels to supply equivalent energy could result in avoidable fuel cost premiums of between US$600million and US$900million annually.

Mr. Apetorgbor also highlighted that existing PPAs remain contractually binding, with capacity payments largely fixed regardless of plant dispatch. Capacity charges across Ghana’s thermal fleet typically range from US$90,000 to US$130,000 per MW per month, depending on plant technology and financing structure.

With over 3,000MW of contracted thermal capacity, he said, annual capacity charge obligations exceed US$3.5billion to US$4billion. Introducing new generation to meet incremental demand, rather than displacing existing baseload, would help avoid under-dispatch and accumulation of idle capacity charges – thereby preserving the financial equilibrium of current PPAs.

However, he warned that delays in capacity additions beyond the 2028–2030 projected supply shortfall window could materially weaken system reliability. Studies indicate that reserve margins could fall below the 15 percent planning threshold, increasing the Loss of Load Probability (LOLP).

“Historically, such conditions have led to emergency power procurement at tariffs of between US$0.20 and US$0.30 per kilowatt-hour, compared with long-run thermal generation costs of about US$0.08 to US$0.12 per kilowatt-hour.

For a conservative estimate of 1,000 gigawatt-hours of unmet energy annually, emergency power could impose additional fiscal and consumer costs of between US$80million and US$180million per year – excluding wider economic impacts such as lost industrial output and weakened investor confidence.

Despite economic arguments in favour of the project, the Africa Sustainable Energy Centre (ASEC) questioned its alignment with Ghana’s climate commitments and energy transition objectives.

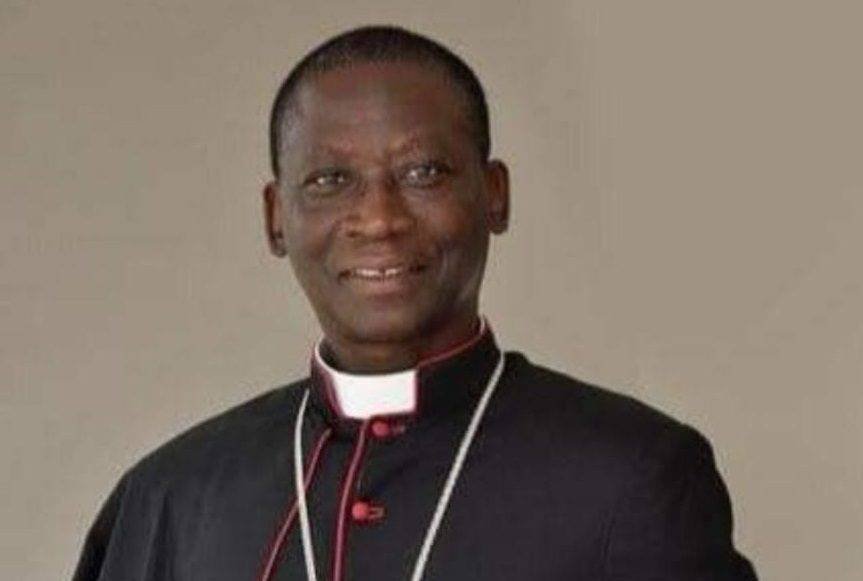

“The target is for at least 10 percent of our energy mix to come from renewables, mainly solar and wind. Adding a large thermal power plant at this stage undermines that commitment,” said the Executive Director of ASEC, Justice Ohene-Akoto.

If government proceeds with the project, ASEC is urging strong investment in carbon mitigation measures.

“We must go heavily into carbon capture technologies. Thermal plants inevitably increase carbon emissions and that has to be addressed,” he said, adding that afforestation and accelerated renewable energy deployment should remain central to Ghana’s power strategy.

“If you produce one tonne of carbon, you must have mechanisms to capture it. At the same time, we cannot lose sight of expanding renewable energy options because they give the country flexibility and resilience.”

The post Mixed reactions greet state-owned power plant initiative appeared first on The Business & Financial Times.

Read Full Story

Facebook

Twitter

Pinterest

Instagram

Google+

YouTube

LinkedIn

RSS